- Home

- Blog

- Web Design 10 Best Online Payment Services & Systems in 2024

10 Best Online Payment Services & Systems in 2024

-

Published: Feb 2, 2024

Published: Feb 2, 2024

-

11 min. read

11 min. read

-

William Craig

William Craig CEO & Co-Founder

CEO & Co-Founder

- President of WebFX. Bill has over 25 years of experience in the Internet marketing industry specializing in SEO, UX, information architecture, marketing automation and more. William’s background in scientific computing and education from Shippensburg and MIT provided the foundation for MarketingCloudFX and other key research and development projects at WebFX.

Online payment processing services streamline online shopping experiences, giving users a positive experience and helping businesses earn more sales.

If you’re looking for the best online payment systems in 2024, you’re in the right place. Keep reading to see our full list of the top online payment services this year!

10 Best online payment systems

- Authorize.net — Best overall

- PayPal — Best for sending and receiving payments

- Google Pay — Best for storing multiple payment methods

- Amazon Pay — Best for a streamlined checkout

- Dwolla — Best for third-party integrations

- Stripe — Best for customization

- Braintree — Best for high sales volumes

- WePay — Best for quick deposits

- Verifone — Best for pay and subscription management

- Helcim — Best for creating invoices and in-person transactions

While you’re here, you can also subscribe to our free newsletter to get the latest ecommerce and digital marketing tips delivered to your inbox.

Don’t miss our Marketing Manager Insider emails!

Join 200,000 smart marketers and get the month’s hottest marketing news and insights delivered straight to your inbox!

Enter your email below:

Inline Subscription Form – CTA 72

“*” indicates required fields

(Don’t worry, we’ll never share your information!)

10 best online payment services and systems of 2024

Check out our table below and then keep reading for a break-down of the best online payment systems for 2024!

| Top online payment services | Best for | Payment Processing Fees | Pricing |

| Authorize.net | Best overall | 2.9% + $0.30 per transaction | $25 per month |

| PayPal | Sending and receiving payments | 2 – 4% + $0.49 per transaction | Free |

| Google Pay | Storing multiple payment methods | No fees | Free |

| Amazon Pay | Streamlined checkout | 2.9% + $0.30 per transaction; 4% + $0.30 per Alexa payment | Free |

| Dwolla | Third-party integrations | 0.5% per transaction | Starting at $250 per month |

| Stripe | Customization | 2.9% + $0.30 per transaction | Free |

| Braintree | High sales volumes | 2.59% + $0.49 per transaction | Free |

| WePay | Quick deposits | 2.9% + $0.30 per transaction | Custom |

| Verifone | Pay and subscription management | 3.5% + $0.35 per transaction | Custom |

| Helcim | Creating invoices and in-person transactions | 0.5% + $0.25 (capped at $6 per transaction) | Free |

1. Authorize.net

Best for: Best overall

Pricing: $25 per month

Payment processing fees: 2.9% + $0.30 per transaction

With a user base of more than 445,000 merchants, Authorize.net is one of the Internet’s most widely used payment gateways. This payment solution from Visa has been around since 1996 and now handles more than a billion transactions per year.

Many widely used e-commerce platforms, such as Magento, Volusion, and X-Cart, integrate easily with Authorize.net.

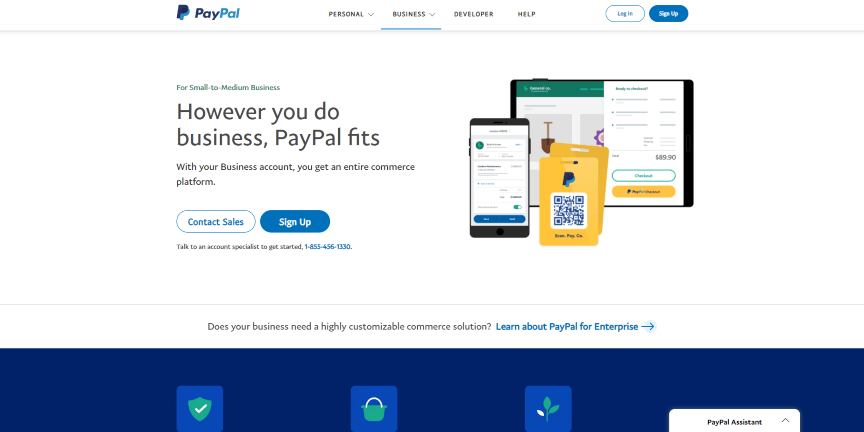

2. PayPal

Best for: Sending and receiving payments

Pricing: Free

Payment processing fees: 2 – 4% + $0.49 per transaction

PayPal is the world’s most widely used payment acquirer, processing over 22,3 billion payments in 2022. More than 30 million merchants and 400 million active customers use PayPal.

Payments are made using a user’s existing account or with a credit card. Money can be sent directly to an email address, thus prompting the users to sign up for a new PayPal account.

In addition to taking payments, PayPal also allows its users to send money through the service, which is a feature that only a few online payment solutions provide.

3. Google Pay

Best for: Storing multiple payment methods

Pricing: Free

Payment processing fees: No fees

Google Pay is Google’s answer to PayPal. Google Pay allows users to pay for goods and services through an account connected to their Google profile.

A major benefit that Google Pay has over the competition is that millions of Internet users use Google for other services, making a purchase through Google Pay a simpler process.

4. Amazon Pay

Best for: A streamlined checkout

Pricing: Free

Payment processing fees: 2.9% + $0.30 per transaction; 4% + $0.30 per Alexa payment

Amazon Pay allows shoppers to easily make purchases using the payment methods saved in their Amazon account online and by voice using Amazon Alexa. Merchants can add an Amazon Pay button to their checkout processes.

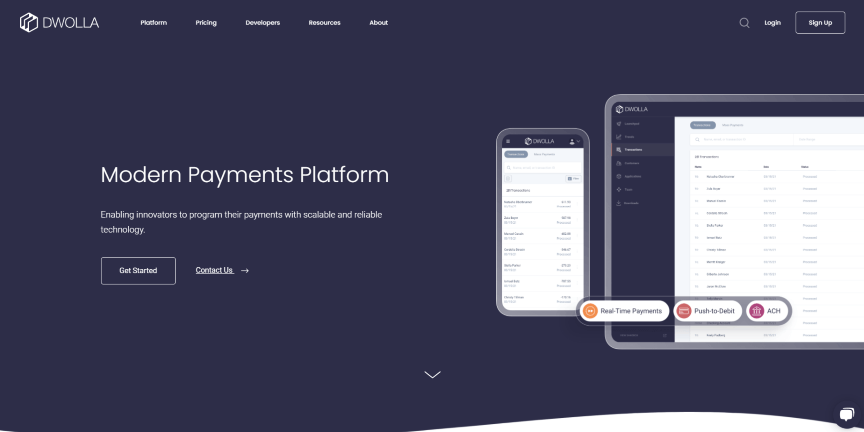

5. Dwolla

Best for: Third-party integrations

Pricing: Starting at $250 per month

Payment processing fees: 0.5% per transaction

Dwolla is another payment platform option that emphasizes simplicity and security. It offers numerous features such as digital wallets, the ability to send up to 5000 payments at once, real-time payments to banks participating in the RTP® Network, and same-day ACH payments.

6. Stripe

Best for: Customization

Pricing: Free

Payment processing fees: 2.9% + $0.30 per transaction

Stripe provides an excellent payment solution for web developers who would like to integrate a payment system into their projects using Stripe’s robust API. By bypassing the traditional signup process, Stripe acts as a merchant account for its providers, handling all Payment Card Industry (PCI) compliance and merchant approvals.

7. Braintree

Best for: High sales volumes

Pricing: Free

Payment processing fees: 2.59% + $0.49 per transaction

Braintree is an online payment gateway and merchant account solution known for working with popular tech startups such as Airbnb and StubHub.

PayPal acquired the company in 2013, and Braintree is now part of the PayPal ecosystem. Braintree, however, is geared toward companies with high sales volumes that need customization capabilities.

With Braintree, customers can also use a range of online payment methods, including PayPal, Venmo, debit and credit cards, Google Pay, and more.

8. WePay

Best for: Quick deposits

Pricing: Custom

Payment processing fees: 2.9% + $0.30 per transaction

WePay is an online payment solutions company that provides payments infrastructure for independent software vendors and software platforms.

This infrastructure enables small businesses to accept payments through the software platforms. JPMorgan Chase acquired WePay in 2017, which enabled functionality such as same-day deposits to Chase bank accounts.

9. Verifone

Best for: Pay and subscription management

Pricing: Custom

Payment processing fees: 3.5% + $0.35 per transaction

Verifone is a payment solutions company that began with point-of-sale hardware and now also focuses on software applications.

The company acquired 2Checkout in 2020, which enabled it to expand further into ecommerce. 2Checkout, which is now part of Verifone, offers various digital commerce solutions, including payments, billing, and subscription management.

10. Helcim

Best for: Creating invoices and in-person transactions

Pricing: Free

Payment processing fees: 0.5% + $0.25 (capped at $6 per transaction)

Helcim is one of the best online payment systems for businesses that have a lot of transactions to process. That’s because you get discounts on processing payment fees.

Not sure how much you’ll save with Helcim’s rates? You can use its online calculator.

You can generate invoices and set up subscriptions. This online payment system can also process in-person payments and international transactions.

Helcim doesn’t charge you monthly fees and doesn’t lock you in with a contract.

Online payment services FAQs

Get answers to common questions about online payment processing services here:

- What is an online payment system?

- Why are online payment systems necessary?

- How does the online payment process work?

- How do I choose the best online payment system for my business?

- What do these common online payment terms mean?

Let’s answer them here:

1. What is an online payment system?

An online payment system is a system that facilitates electronic payment for goods and services.

It involves all processes that enable payment transfers — the payment gateway, payment processor, and merchant account.

2. Why are online payment systems necessary?

Today, purchasing products and services online is more common than ever. In fact, by the year 2040, more than 95% of purchases will be made online.

Online payment services offer a number of benefits to both businesses and consumers, including:

- A streamlined shopping experience

- Keeping payment information secure

- Organizing purchases and transactions

- And much more

Quick and simple shopping experiences are key to creating a positive user experience and boosted sales.

3. How does the online payment process work?

Businesses will follow their online payment system’s instructions for setting up the check out process on their website.

Then, when users make a purchase, they will be asked to enter their card details to pay. Users may also be asked to select the payment method they wish to use, such as PayPal or Google Pay.

If users opt to pay with a payment service such as PayPal or Google Pay, they will be asked to sign into their account if they’re not already. They will then complete their purchase using the service.

If users decide to enter their card details on the website, the company’s online payment service will verify the card details and ensure the customer has enough funds to complete the transaction.

The transaction will then be completed.

4. How do I choose the best online payment system for my business?

When choosing an online payment system for your business, consider the following:

- Security

- Cost

- Integrations

- Payment methods

Let’s go through each one:

1. Security

Security is one of the most important considerations when choosing an online payment system. Shortlist only PCI-compliant online payment systems.

Make sure these systems also use the latest encryption technologies that protect your customers’ card information from theft.

2. Cost

Most online payment systems have subscription or payment processing fees.

A subscription fee is a monthly or yearly fee that the service charges. Meanwhile, a payment processing fee refers to the charges for every transaction.

Note that some online payment services don’t charge a subscription fee, but they may have higher payment processing charges.

When comparing the fees of different online payment systems, research other possible charges like:

- Setup fees

- Hidden charges

- Refund fees

- International transaction charges

3. Integrations

You must be able to integrate your online payment system into your shopping cart and other apps you use for your business, like accounting software.

Integrations enable you to automate parts of your process, thus saving you time.

4. Payment methods

Find out the payment methods the system supports. It must accept credit card payments and your customers’ other preferred modes of payment like PayPal.

If your customers prefer the pay-by-invoice option, shortlist systems that have this capability.

5. What do these online payment terms mean?

Here are some definition for terms related to online payment systems:

ACH payments

ACH stands for Automated Clearing House. ACH payments refer to electronic credit and debit transfers, allowing customers to make payments from their bank accounts for utilities, mortgage loans, and other types of bills.

Most payment processors offer ACH payment options to their customers, especially for monthly- and subscription-based transactions. Most payment solutions use ACH to send money (minus fees) to their customers.

Merchant account

A merchant account is a bank account that allows a business to receive payments through credit or debit cards. Merchant providers are required to obey regulations established by card associations. Many processors act as both the merchant account and the payment gateway.

Payment gateway

A payment gateway is a service that enables a merchant to process card transactions. It securely passes credit card information between the customer, the merchant, and the payment processor. The payment gateway is the middleman between the merchant and their sponsoring bank.

Payment processor

A payment processor is the company that a merchant uses to handle credit card transactions. Payment processors implement anti-fraud measures to ensure that both the front-facing customer and the merchant are protected.

PCI compliance

PCI compliance is when a merchant or payment gateway sets its payment environment up in a way that meets the Payment Card Industry Data Security Standard (PCI DSS). The PCI DSS standard was created by the PCI Security Standards Council to increase security of cardholder data and to reduce fraud.

Partner with a team of ecommerce masters!

WebFX campaigns have delivered more than 14,936,451 ecommerce transactions in the last 5 years

Read the Case Studies

Choosing the right online payment solution for your needs

There are plenty of online payment systems out there that you can use to conduct ecommerce activities. Choose one that’s in line with your business objectives.

If you work with an ecommerce marketing agency, such as WebFX, ask your account manager what they suggest based on their experience. To get started with our ecommerce services, contact us online or call us at 888-601-5359.

-

President of WebFX. Bill has over 25 years of experience in the Internet marketing industry specializing in SEO, UX, information architecture, marketing automation and more. William’s background in scientific computing and education from Shippensburg and MIT provided the foundation for MarketingCloudFX and other key research and development projects at WebFX.

President of WebFX. Bill has over 25 years of experience in the Internet marketing industry specializing in SEO, UX, information architecture, marketing automation and more. William’s background in scientific computing and education from Shippensburg and MIT provided the foundation for MarketingCloudFX and other key research and development projects at WebFX. -

WebFX is a full-service marketing agency with 1,100+ client reviews and a 4.9-star rating on Clutch! Find out how our expert team and revenue-accelerating tech can drive results for you! Learn more

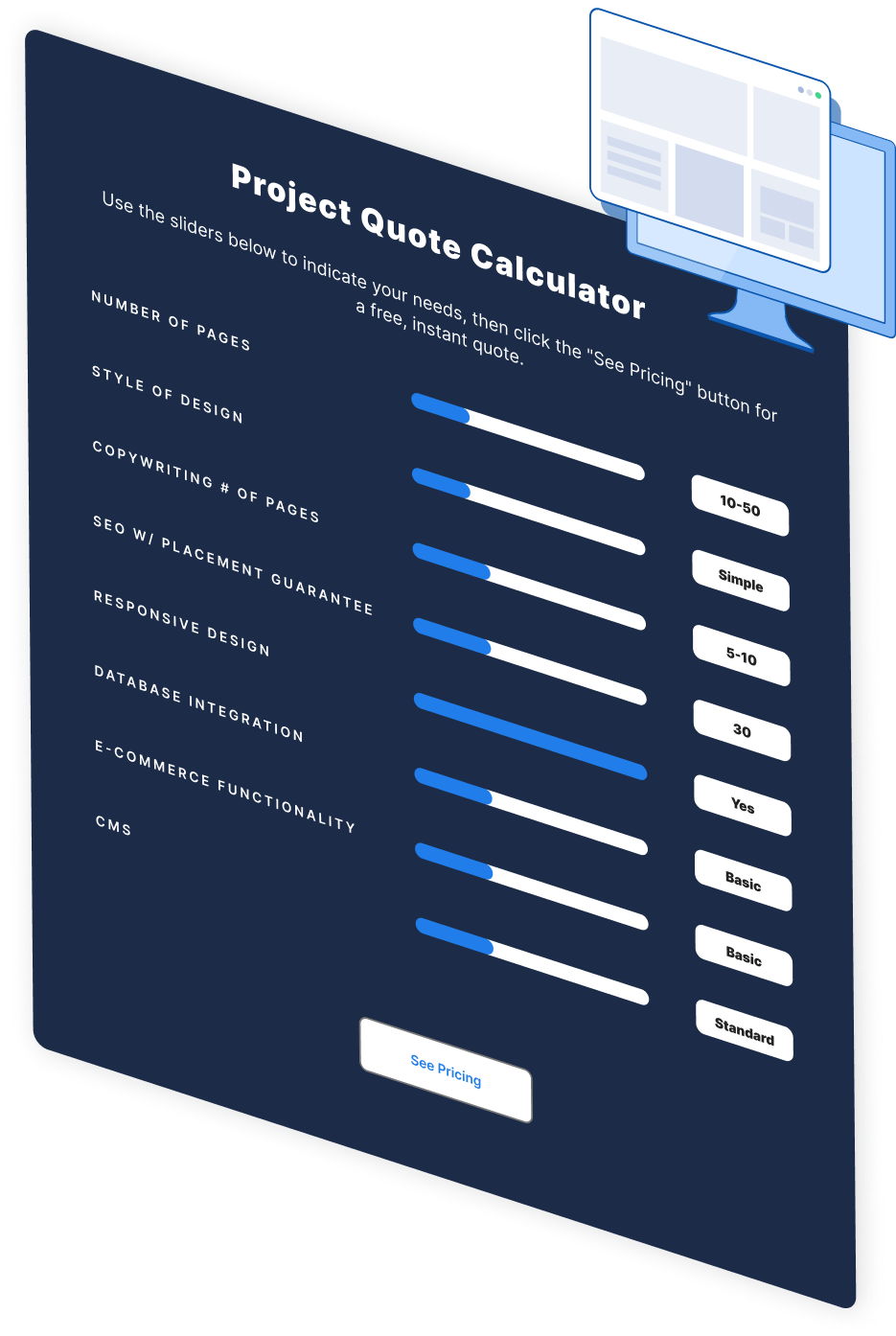

Make estimating web design costs easy

Website design costs can be tricky to nail down. Get an instant estimate for a custom web design with our free website design cost calculator!

Try Our Free Web Design Cost Calculator

Table of Contents

- 10 Best Online Payment Systems of 2024

- 1. Authorize.net

- 2. PayPal

- 3. Google Pay

- 4. Amazon Pay

- 5. Dwolla

- 6. Stripe

- 7. Braintree

- 8. WePay

- 9. Verifone

- 10. Helcim

- Online Payment Services FAQs

- 1. What is an Online Payment System?

- 2. Why Are Online Payment Systems Necessary?

- 3. How Does the Online Payment Process Work?

- 4. How Do I Choose the Best Online Payment System for My Business?

- 5. What Do These Online Payment Terms Mean?

- Choosing the Right Online Payment Solution for Your Needs

Web Design Calculator

Use our free tool to get a free, instant quote in under 60 seconds.

View Web Design CalculatorMake estimating web design costs easy

Website design costs can be tricky to nail down. Get an instant estimate for a custom web design with our free website design cost calculator!

Try Our Free Web Design Cost Calculator